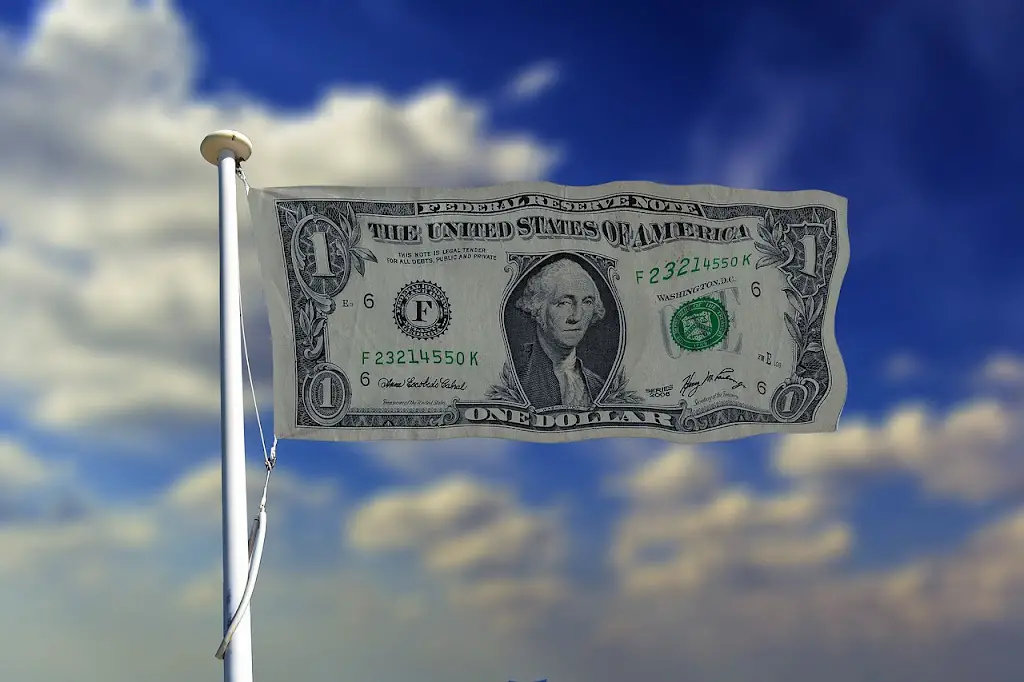

The US financial system: resilience and vulnerabilities

Resilience: a solid foundation

- Regulatory Framework : The US financial system operates within a comprehensive regulatory framework. Institutions like the Federal Reserve play a crucial role in maintaining stability through implementing prudent policies and supervising financial institutions.

- Diversification : The system is highly diversified, with a multitude of banks, investment companies and other financial entities. This diversification distributes risk and prevents a single failure from triggering a systemic collapse.

- Liquidity : The Federal Reserve’s ability to inject liquidity during crises has been key. Programs such as quantitative easing and emergency lending facilities have bolstered the system during turbulent times.

- Technological advances : The US financial sector has embraced technology, improving efficiency, transparency and risk management. Digital payment systems, blockchain and cybersecurity measures contribute to its resilience.

Vulnerabilities: future challenges

- Debt levels : Rising hedge fund debt , often unreported by regulatory authorities, represents a significant risk. Excessive leverage can amplify market shocks and destabilize the system.

- Cybersecurity Threats : The financial system faces an ever-evolving cyber threat landscape. Malware, supply chain risks, and data breaches continue to be persistent challenges .

- Non-Bank Financial Intermediation : The growth of non-bank financial entities (shadow banking system) introduces vulnerabilities. These entities operate outside of traditional regulatory oversight, potentially amplifying systemic risks .

- Climate change : As climate-related risks intensify, the financial system must adapt. Exposure to climate-sensitive assets and the potential impact on insurance companies, banks and pension funds requires careful analysis.